richmond property tax calculator

Home City Hall Finance Taxes Budgets Property Taxes Tax Rates. Website Design by Granicus - Connecting People and Government.

The City Assessor determines the FMV of over 70000 real property parcels each year.

. Object Moved This document may be found here. The median property tax on a 9930000 house is 82419 in Georgia. The median property tax on a.

Real Estate and Personal Property Taxes Online Payment. Greater Vancouver Transportation Authority TransLink 604-953-3333. The median property tax.

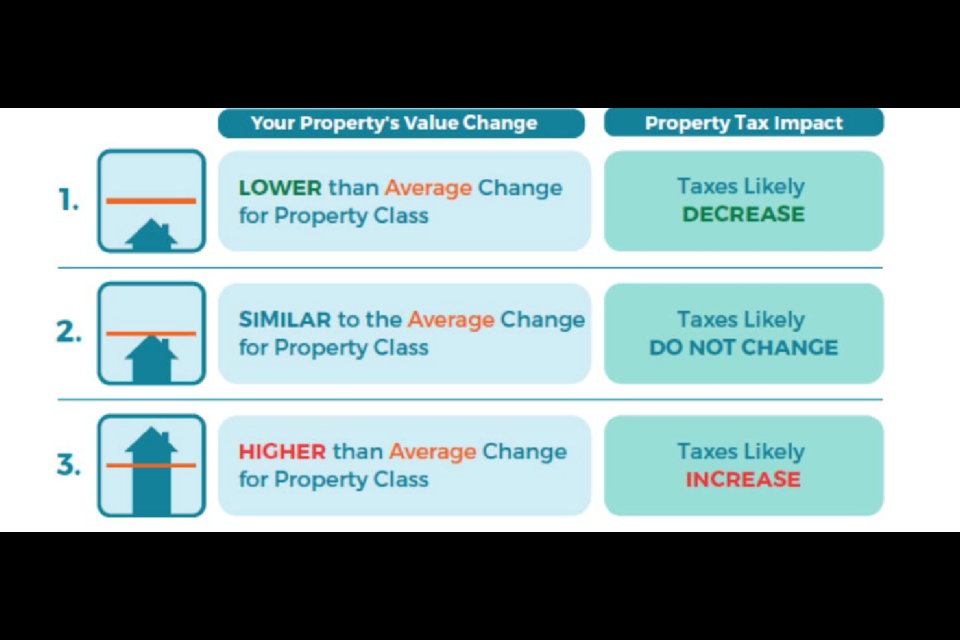

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered. When summed up the property tax burden all owners bear is. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

295 with a minimum of 100. Box 4277 Houston TX 77210-4277. Once market values are recorded Richmond along with other in-county governing units will calculate tax rates alone.

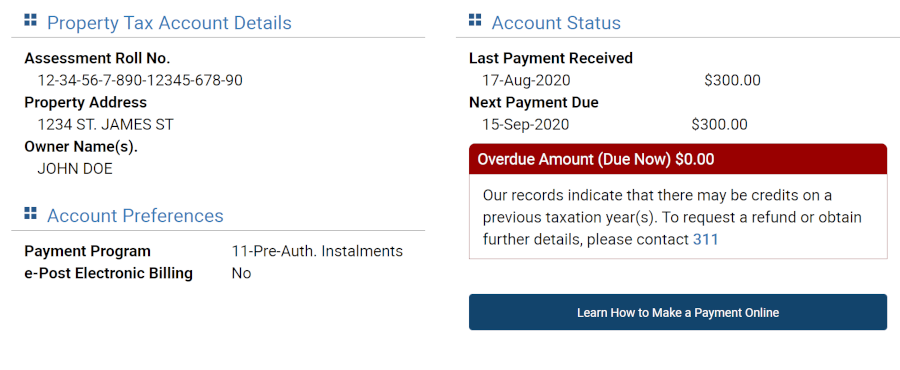

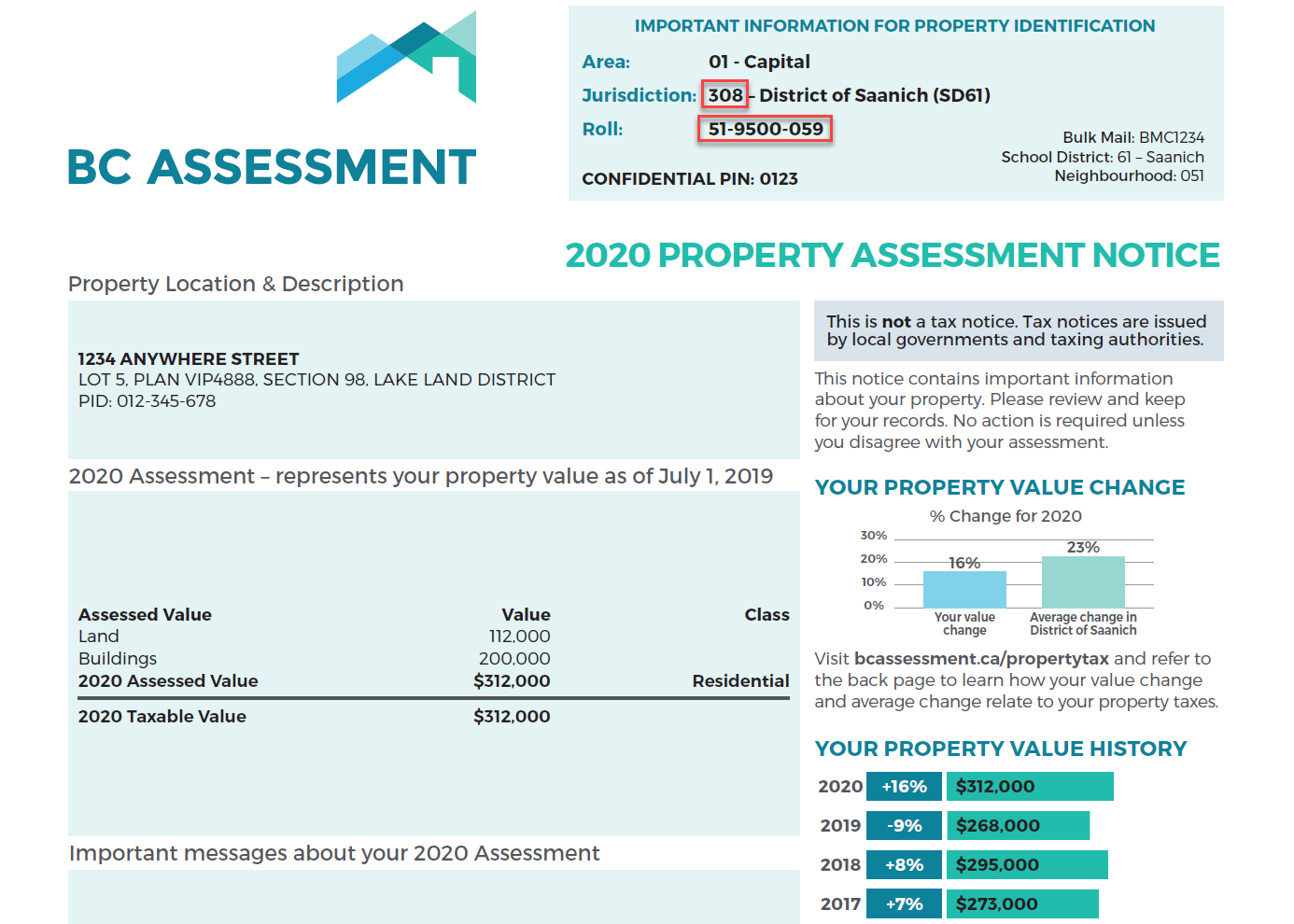

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access. These documents are provided in Adobe Acrobat PDF format for printing.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the. The median property tax on a 7130000 house is 73439 in Richmond County. In fact the states average effective property tax rate is just 080 which falls in the bottom half of the nation.

With an average effective property tax rate. The median property tax on a 9930000 house is 91356 in Richmond County. Once market values are assessed Richmond together with other in-county public units will set tax rates alone.

Calculate how much youll pay in property taxes on your home. Electronic Check ACHEFT 095. The median property tax on a 7130000 house is 55614 in North Carolina.

Submit Tax Payments PO. A composite rate will generate counted on total tax receipts and also generate. Please note that we can.

City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456. Richmond City collects on average 105 of a propertys. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

Richmond Hill has partnered with Paymentus Corporation a third-party service provider to bring you the convenience of paying your property tax online with your Visa or. In Person at the counter Property Tax Payment Fees.

Where Do I Find My Folio Number And Access Code Myrichmond Help

Average Residential Tax Bill Amount

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Lower Mainland 2022 Property Assessments In The Mail

Property Assessment Assessment Search Service Frequently Asked Questions

Property Tax Calculation Youtube

The Annual Property Operating Data Apod Why Real Estate Investors Use It And How To Construct

Rental Property Management Spreadsheet Template

Real Estate Capital Gains Taxes When Selling A Home Including Rates Capital Gain Real Estate Articles Sale House

New York Buyer Picks Up Northside Apartments Richmond Bizsense Apartment Projects Local Real Estate Commercial Real Estate

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province

Paying Your Property Tax City Of Terrace